February 05, 2026

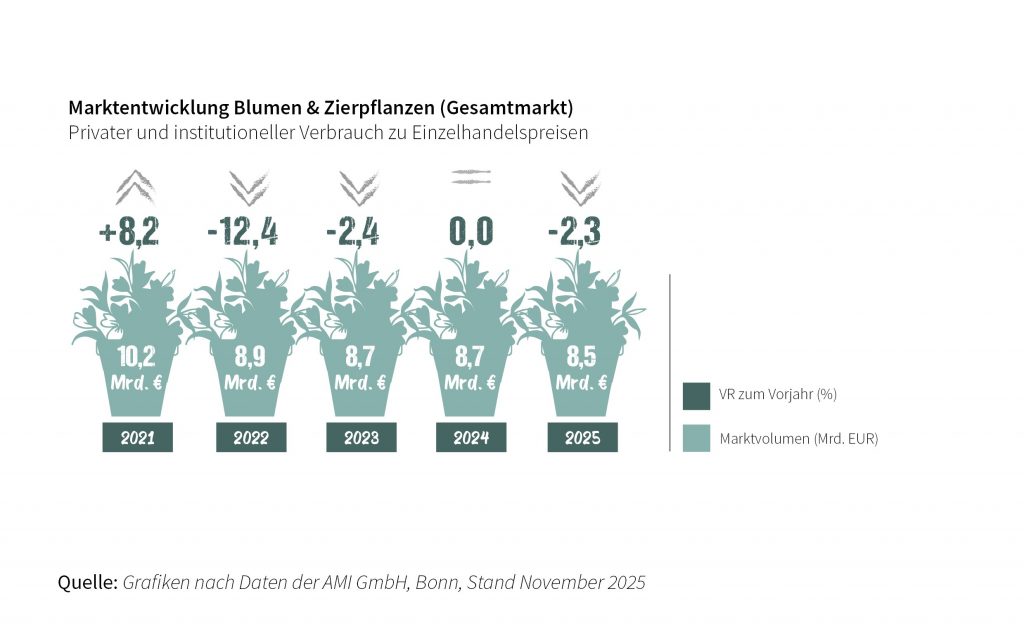

Persistent caution among German consumers continues to suppress demand for flowers and ornamental plants, creating headwinds for Kenyan exporters supplying this key market. Fresh market data indicate that the sector failed to rebound in 2025, with subdued consumer spending driven by ongoing economic uncertainty, real income erosion, and high living costs.

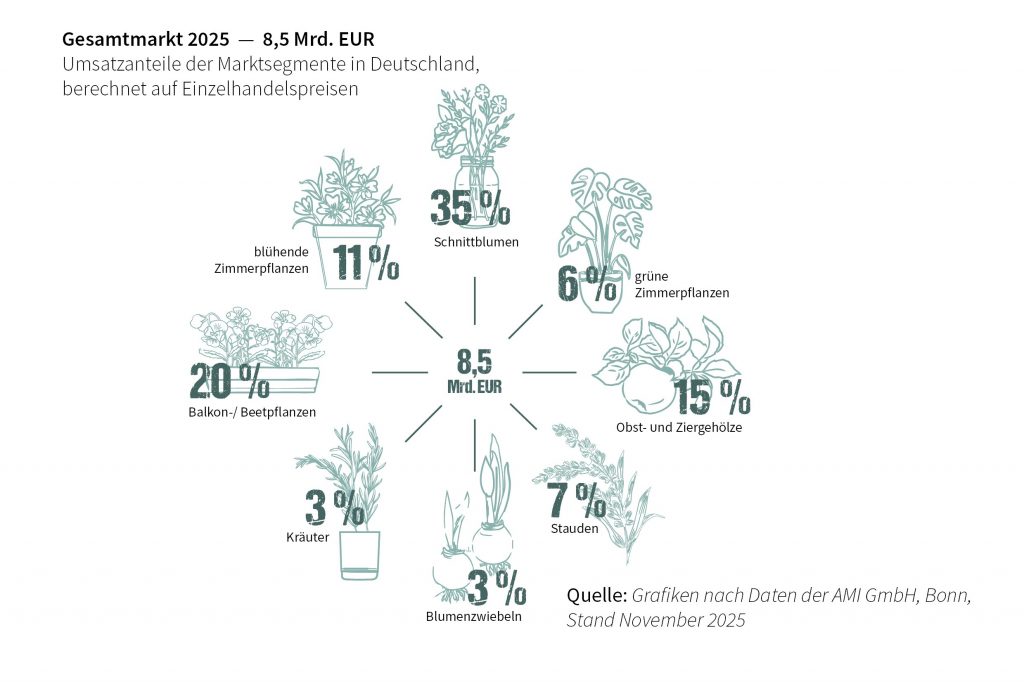

According to estimates by Germany’s Agrarmarkt Informations-Gesellschaft (AMI), based on the first three quarters of 2025, the market declined to €8.5 billion at retail value in 2025. Per capita spending fell by more than €2 to approximately €102, remaining well below pre-pandemic levels. These trends suggest structural rather than short-term challenges, with retailers and suppliers adjusting cautiously to demand realities.

Cut flowers, the most relevant segment for Kenyan exporters, also recorded a weaker performance. Per capita spending dropped to below €36, pushing total market value to just under €3 billion. Reduced discretionary spending and cautious purchasing patterns across supermarkets and florists have directly affected import volumes and pricing power.

Houseplants and garden plants similarly underperformed. The houseplant segment contracted by 4.5% year-on-year to €1.4 billion, while garden plants slipped by over 1%, influenced by unfavorable weather and cautious consumer behavior. Except for flower bulbs, all sub-segments recorded lower consumer spend.

Industry leaders remain cautiously optimistic. ZVG President Eva Kähler-Theuerkauf notes that product potential remains intact, but recovery hinges on the return of consumer confidence. For Kenyan exporters, this underscores the importance of market diversification, value differentiation, sustainability credentials, and tight cost control as Europe navigates a slow demand cycle.

While policy measures aimed at stimulating European economies are expected in 2026, their impact is likely to be delayed. In the near term, exporters should plan for continued demand softness, prioritize resilient retail channels, and align supply with evolving consumer preferences focused on value, longevity, and sustainability.

| FAQ |

|---|

| How big is the German Flower Market? Germany is Europe’s top flower market, with annual sales of €8.8 billion across cut flowers, potted plants, and garden plants. The cut flower segment alone pulls in €3 billion, driven by strong consumer demand for gifts, home décor, and special occasions. Germany also plays a key role as a distribution hub for imported flowers, especially from the Netherlands, while wholesale trade is projected at €8.4 billion by 2025. With steady growth on the horizon, the German flower market remains a vital and expanding hub for both local growers and international suppliers, highlighting Europe’s love for blooms and opportunities for investment in floriculture. How important is the German market both globally and for Kenyan growers? Being Europe’s largest flower market, its demand shapes international trade, as major flower producers like the Netherlands, Colombia, Ethiopia, and Kenya rely on German importers to reach European consumers. Strong purchasing power, high frequency of flower gifting, and well-developed retail and wholesale networks make Germany a trend-setting market, influencing prices, varieties, and standards worldwide. For Kenyan flower growers, Germany is a critical export destination. A significant share of Kenya’s cut flowers is sold there, generating substantial foreign exchange. German buyers’ demand for high-quality products ensures Kenyan growers maintain competitive standards and secure premium prices. The market’s size and consistency provide stability, helping buffer against fluctuations in other regions. Additionally, adhering to Germany’s strict quality and sustainability standards encourages innovation, traceability, and compliance with EU regulations, thereby boosting Kenya’s global competitiveness. In short, it is a strategic partner that sets benchmarks for quality, pricing, and sustainable floriculture. Kenya’s Flower Exports to Germany Kenya is a leading global exporter of cut flowers, with Europe as its main destination. Germany is a key market, receiving approximately US $47 million worth of flowers and ornamental plants in 2024, accounting for around 4–6% of Kenya’s total flower exports. Between July and September 2025, Kenya’s horticultural exports to Germany were valued at US $12.5 million, with flowers making up the majority. Overall, Germany’s demand for Kenyan flowers reflects strong European interest in premium, sustainably produced blooms, offering opportunities for growth and deeper trade partnerships. |