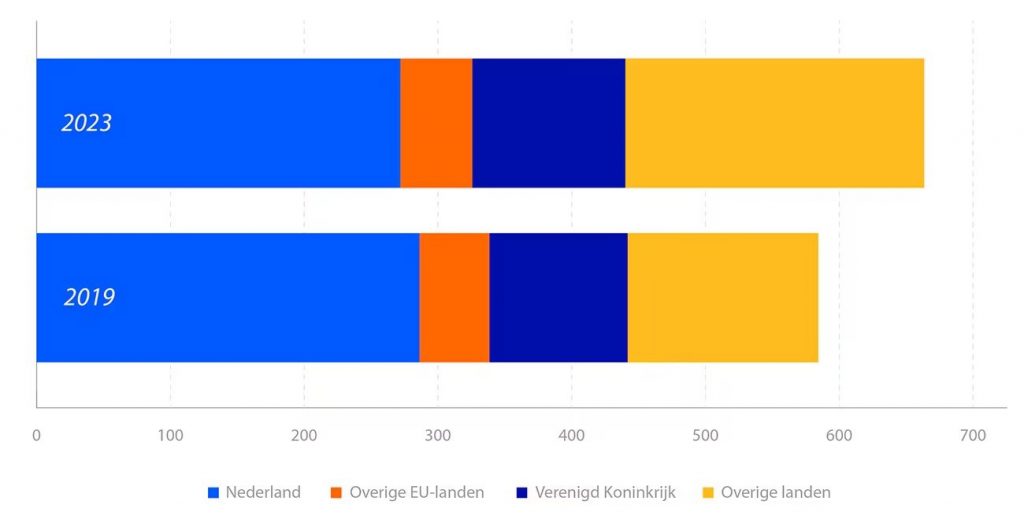

While the Netherlands is a major player in the global cut flower market, importing flowers from various countries, Kenya and Ethiopia have shifted focus during the pandemic. They recognized the risks of relying solely on the Netherlands for logistics and are now exploring new export channels. Rabobank reports that the early impacts of this change are evident in the 2023 trade statistics (see Figure 2).

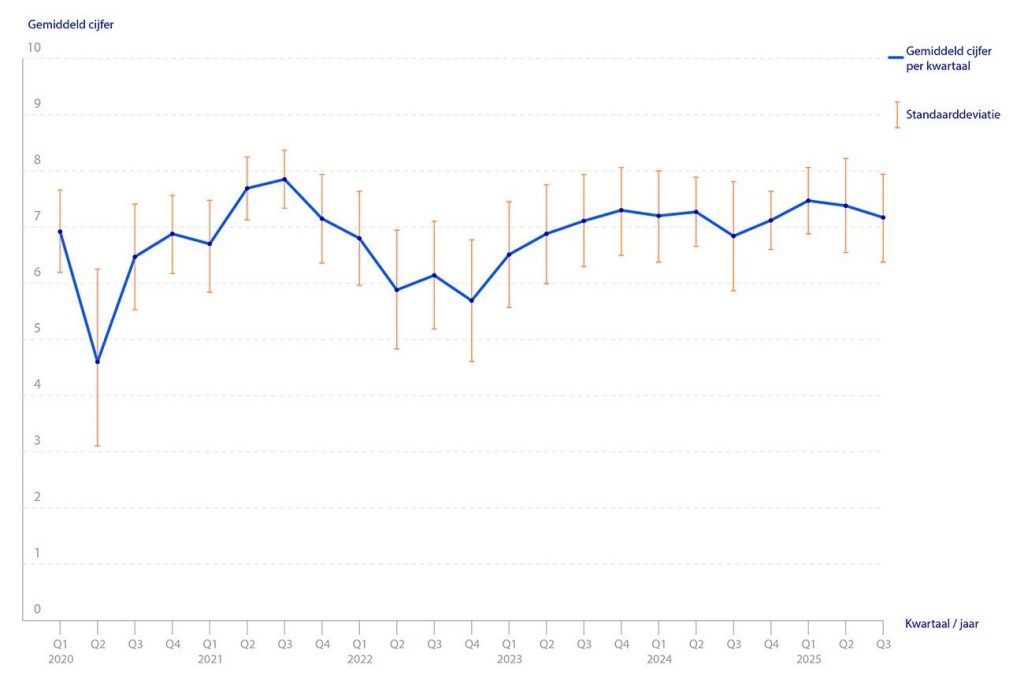

Figure 2 shows a significant shift in Kenya’s flower trade. Between 2019 and 2023, the share of Kenya’s cut flower export value to the EU and UK fell from 75.6% to 66.3%. This decline isn’t due to reduced exports to Europe, which have remained stable at around 440 million US dollars. Instead, it reflects a rise in exports to other markets, with non-European flower exports increasing from 142 million to 223 million US dollars during the same period. Kenya has successfully developed new logistics channels, with the Middle East and Kazakhstan emerging as key growth markets for its expanding cut flower supply. Economically, horticulture is thriving, with Rabobank’s horticulture barometer indicating a positive outlook, scoring 7.17 in Q3 this year on a scale of 0 to 10. Figure 1 illustrates this indicator’s development over the past five years, showing a consistent score of 7 or higher since Q2 2023.

The greenhouse vegetable sector reports a more cautious outlook compared to the previous quarter, with average prices for tomatoes, peppers, and cucumbers down from 2024. On a positive note, fewer virus outbreaks are reported as many tomato growers switch to resistant varieties, and pepper growers have largely addressed root issues.

Cut flower prices remain strong despite a slightly lower-than-expected spring supply due to limited tulip bulb stocks. Potted plant prices and volumes are stable, though standard foliage plants are still sold below production costs. Floridata reports a 2.7% increase in the export value of cut flowers and potted plants in the first half of 2025 compared to last year.

Tulip growers are having a successful harvest, with promising pre-sales of bulbs. Lily growing conditions have been excellent until July 2025, and peonies have also produced a strong harvest, though results vary by sales strategy. Growers with fixed contracts face less price pressure, while daffodil and calla lily markets are under some pressure.

at the same budget can cover. A slight recovery from €53 million in 2023 to €68 million in 2024 is promising, but it is not yet a true turnaround.

Source: Rabobank