Alittle creature has been the cause of much destruction in the ornamental and horticultural industry recently. This fuss is all about the False Codling Moth (FCM –Thaumatotibia leucotreta). Three years ago, False Codling Moth was classified by Europe as a quarantine pest and member countries were recommended to regulate its presence. So, what is going on? Are we looking at a serious threat to the ornamental and horticultural sector?

Alittle creature has been the cause of much destruction in the ornamental and horticultural industry recently. This fuss is all about the False Codling Moth (FCM –Thaumatotibia leucotreta). Three years ago, False Codling Moth was classified by Europe as a quarantine pest and member countries were recommended to regulate its presence. So, what is going on? Are we looking at a serious threat to the ornamental and horticultural sector?

No. Not at all, thanks to Madumbi Kenya Limited. Farmers preparing their spray programs can now include Cryptex® a cutting edge granulovirus technology for the suppression of False Codling Moth (FCM).

Summer is around the corner, and it will most likely be another record-breaking one. On those blazing hot summer days, you are doing everything possible to stay cool, aren’t you? Well, flowers require the same!

Summer is around the corner, and it will most likely be another record-breaking one. On those blazing hot summer days, you are doing everything possible to stay cool, aren’t you? Well, flowers require the same!

Packaging might be the unsung hero of the fresh produce industry. It might not be the sexiest part of the supply chain. It is a sector that might be perceived – wrongly – as a less glamorous component of the supply chain. But without adequate solutions that work up and down the chain, produce will never arrive for presentation at the right quality.

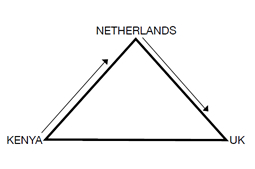

Packaging might be the unsung hero of the fresh produce industry. It might not be the sexiest part of the supply chain. It is a sector that might be perceived – wrongly – as a less glamorous component of the supply chain. But without adequate solutions that work up and down the chain, produce will never arrive for presentation at the right quality. The Covid-19 pandemic is highlighting the supply chain problems which can arise when border clearance arrangements come under stress from increased demands and reduced capacities. This is bringing into question the future commercial viability of existing ACP triangular supply chains for short shelf life products in serving the UK market.

The Covid-19 pandemic is highlighting the supply chain problems which can arise when border clearance arrangements come under stress from increased demands and reduced capacities. This is bringing into question the future commercial viability of existing ACP triangular supply chains for short shelf life products in serving the UK market. The floriculture is hit hard by the COVID-19 crisis, but when looking at the past, present and future, how is the industry expected to develop and recover? Rabobank tried to predict the global economic impacts and the effects on the floriculture industry. Lambert van Horen, Analyst – Fresh Produce at Rabobank, a Dutch bank with clients all over the world, was present at the PMA Virtual Town Hall*, to give an insight in the scenario they outlined.

The floriculture is hit hard by the COVID-19 crisis, but when looking at the past, present and future, how is the industry expected to develop and recover? Rabobank tried to predict the global economic impacts and the effects on the floriculture industry. Lambert van Horen, Analyst – Fresh Produce at Rabobank, a Dutch bank with clients all over the world, was present at the PMA Virtual Town Hall*, to give an insight in the scenario they outlined. With the world’s human population expected to reach nearly 10 billion by 2050 and the negative impact of climate change on agriculture, maintenance of a stable global food supply is under significant threat.

With the world’s human population expected to reach nearly 10 billion by 2050 and the negative impact of climate change on agriculture, maintenance of a stable global food supply is under significant threat. The EU continues to set and re-set pesticide and fungicide Maximum Residue Level (MRLs) at far stricter levels than internationally agreed standards. ACP exporters serving EU markets have no option but to comply or exit the EU market. Freshfel’s call for ‘better defined international standards’ to facilitate EU fruit and vegetable exports, since uneasily with the unilateral standard setting practiced by the EU, which regularly presents new compliance challenges for ACP fruit and vegetable exporters. This raises important policy issues regarding the EU’s role in the de facto setting of international standards and the limitations of SPS chapters and institutional mechanisms established under trade ACP-EU FTAs for ensuring EU markets remain open to ACP products which comply with agreed international regulatory standards.

The EU continues to set and re-set pesticide and fungicide Maximum Residue Level (MRLs) at far stricter levels than internationally agreed standards. ACP exporters serving EU markets have no option but to comply or exit the EU market. Freshfel’s call for ‘better defined international standards’ to facilitate EU fruit and vegetable exports, since uneasily with the unilateral standard setting practiced by the EU, which regularly presents new compliance challenges for ACP fruit and vegetable exporters. This raises important policy issues regarding the EU’s role in the de facto setting of international standards and the limitations of SPS chapters and institutional mechanisms established under trade ACP-EU FTAs for ensuring EU markets remain open to ACP products which comply with agreed international regulatory standards. The current Covid-19 disruptions of Kenyan exports to Europe, particularly along triangular supply chains to the UK, highlights the importance of shortening supply chains by wherever possible, contracting with the final retailer and shipping products directly. For exporters who can get to grip with current logistical challenges, rising EU demand for fruit and vegetables and rising prices could yield commercial benefits to counter-balance some of the Covid-19 disruptions. This is particularly the case since labour shortages in the fruit and vegetable sectors as a result of disruptions to labour flows could depress fruit and vegetable production throughout 2020.

The current Covid-19 disruptions of Kenyan exports to Europe, particularly along triangular supply chains to the UK, highlights the importance of shortening supply chains by wherever possible, contracting with the final retailer and shipping products directly. For exporters who can get to grip with current logistical challenges, rising EU demand for fruit and vegetables and rising prices could yield commercial benefits to counter-balance some of the Covid-19 disruptions. This is particularly the case since labour shortages in the fruit and vegetable sectors as a result of disruptions to labour flows could depress fruit and vegetable production throughout 2020. With nearly 40% of Kenya’s direct exports to the UK currently benefitting from significant margins of tariff preferences, concerns have arisen around the UK’s current MFN tariff review and the future basis for Kenya’s continued duty-free access to the UK market after 1st January 2021. In addition, there are growing concerns about the future commercial viability of the use of triangular supply chains for the delivery of Kenyan short shelf life products to the UK market if no comprehensive EU/UK trade agreement is in place by 1st January 2021. Any future EU/UK trade agreement would need, as far as possible, to replicate the current frictionless trade, on which the operation of these triangular supply chains depends. This is looking increasingly unlikely. The Government of Kenya thus faces a triple challenge in ensuring a continuation of current patterns of exports to the UK market into 2021.

With nearly 40% of Kenya’s direct exports to the UK currently benefitting from significant margins of tariff preferences, concerns have arisen around the UK’s current MFN tariff review and the future basis for Kenya’s continued duty-free access to the UK market after 1st January 2021. In addition, there are growing concerns about the future commercial viability of the use of triangular supply chains for the delivery of Kenyan short shelf life products to the UK market if no comprehensive EU/UK trade agreement is in place by 1st January 2021. Any future EU/UK trade agreement would need, as far as possible, to replicate the current frictionless trade, on which the operation of these triangular supply chains depends. This is looking increasingly unlikely. The Government of Kenya thus faces a triple challenge in ensuring a continuation of current patterns of exports to the UK market into 2021.