Avocado prices are slowly dropping on the European market. In general, prices are expected to fall sharply in July and August compared to previous months. This is due to the fact that some countries continue to buy smaller volumes than usual because the coronavirus is still having a huge impact. For example, part of the food service in the US is not yet back to its old level. Peru, the world’s largest producer, is therefore selling more volumes on the European market. Other production countries and regions are Mexico, Colombia, California, South Africa, Kenya, Tanzania and Uganda. Peru has a strong presence in both China and India. South African companies are currently also sourcing Peruvian avocados to supplement their own volumes, as they’ve had smaller home-grown volumes than expected. In China, imports are still on the rise; Colombia is perceived as a nice addition to fill the gap between the Chilean and Peruvian seasons. People are also increasingly working on their own production.

Belgium: Low prices for the Hass; Greenskins at their usual price

There is currently a great supply of Hass avocados, as different countries are in production, says a Belgian trader. The demand is at a fairly normal level. As a result, prices for the Hass are quite low and don’t differ much from those of the greenskins. The greenskins are currently imported from Peru and South Africa and the supply is normal.

Alittle creature has been the cause of much destruction in the ornamental and horticultural industry recently. This fuss is all about the False Codling Moth (FCM –Thaumatotibia leucotreta). Three years ago, False Codling Moth was classified by Europe as a quarantine pest and member countries were recommended to regulate its presence. So, what is going on? Are we looking at a serious threat to the ornamental and horticultural sector?

Alittle creature has been the cause of much destruction in the ornamental and horticultural industry recently. This fuss is all about the False Codling Moth (FCM –Thaumatotibia leucotreta). Three years ago, False Codling Moth was classified by Europe as a quarantine pest and member countries were recommended to regulate its presence. So, what is going on? Are we looking at a serious threat to the ornamental and horticultural sector?

Packaging might be the unsung hero of the fresh produce industry. It might not be the sexiest part of the supply chain. It is a sector that might be perceived – wrongly – as a less glamorous component of the supply chain. But without adequate solutions that work up and down the chain, produce will never arrive for presentation at the right quality.

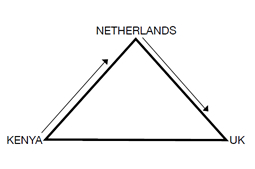

Packaging might be the unsung hero of the fresh produce industry. It might not be the sexiest part of the supply chain. It is a sector that might be perceived – wrongly – as a less glamorous component of the supply chain. But without adequate solutions that work up and down the chain, produce will never arrive for presentation at the right quality. The Covid-19 pandemic is highlighting the supply chain problems which can arise when border clearance arrangements come under stress from increased demands and reduced capacities. This is bringing into question the future commercial viability of existing ACP triangular supply chains for short shelf life products in serving the UK market.

The Covid-19 pandemic is highlighting the supply chain problems which can arise when border clearance arrangements come under stress from increased demands and reduced capacities. This is bringing into question the future commercial viability of existing ACP triangular supply chains for short shelf life products in serving the UK market. The floriculture is hit hard by the COVID-19 crisis, but when looking at the past, present and future, how is the industry expected to develop and recover? Rabobank tried to predict the global economic impacts and the effects on the floriculture industry. Lambert van Horen, Analyst – Fresh Produce at Rabobank, a Dutch bank with clients all over the world, was present at the PMA Virtual Town Hall*, to give an insight in the scenario they outlined.

The floriculture is hit hard by the COVID-19 crisis, but when looking at the past, present and future, how is the industry expected to develop and recover? Rabobank tried to predict the global economic impacts and the effects on the floriculture industry. Lambert van Horen, Analyst – Fresh Produce at Rabobank, a Dutch bank with clients all over the world, was present at the PMA Virtual Town Hall*, to give an insight in the scenario they outlined.